I suppose it depends on how one defines "fiscal responsibility". When determining whether or not the government is on a fiscally sustainable path, the most important measure is government spending as a percentage of GDP. As long as government spending is shrinking relative to the overall size of the economy, you're on a fiscally sustainable path. The sizes of the debt and deficits are of secondary importance. It's possible for President B to run up more total debt than President A but for President B to have the country on a more fiscally sustainable path.

Consider President Bush and President Obama:

President Bush (federal spending pct. GDP)

View attachment 1107

President Obama

View attachment 1108

As you can see, President Obama has run up more total debt. HOWEVER, federal spending as a percentage of GDP has dropped more than risen during his time in office. Meanwhile, under President Bush, federal spending as a percentage GDP rose fairly steadily through his time in office. Obama's trajectory is more fiscally sustainable than Bush's. In fact, the Obama Administration has cited this a major victory. (Incidentally, my major criticisms of Obama are not the size of the debt or federal spending in itself. My major criticisms are his policies. I criticize him for

how he's spent, not

how much he's spent.)

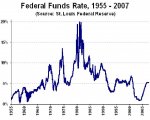

Now, let's look at spending under President Reagan:

View attachment 1109

Depending on where you want to start attributing spending to President Reagan (some people start the tracker a year after the President takes office, some people start it a few months after), federal spending as a percentage of GDP drops anywhere between 1 point and 1.5 points during his time in office.

You'll notice that spending was highest under Reagan during his first years in office -- that's when the bulk of his debt was run up. The debt exploded because inflation collapsed unexpectedly. Reagan and Paul Volker (FED Chairman) wanted to lower inflation as means of ending the stagflation in which the Carter years had been mired, but they didn't expect it to fall so quickly.

I have issues with Clinton as well, but his economic policy was generally decent.

As the following factcheck.org article points out, blaming the housing market collapse on Gramm-Leach-Bliley is overly simplistic. It was a myriad of things.

http://www.factcheck.org/2008/10/who-caused-the-economic-crisis/

. If you can't get laid here, there's no helping you.

. If you can't get laid here, there's no helping you.